If you’ve ever taken the time to read through a credit card processing statement in it’s entirety, it’s often reminiscent of Shakespeare in high school English. It’s not quite a foreign language, but it feels like it is, and just when you think you know what’s going on, you’re thrown for a loop that makes you question if you’ve even been paying attention the entire time. Sound familiar?

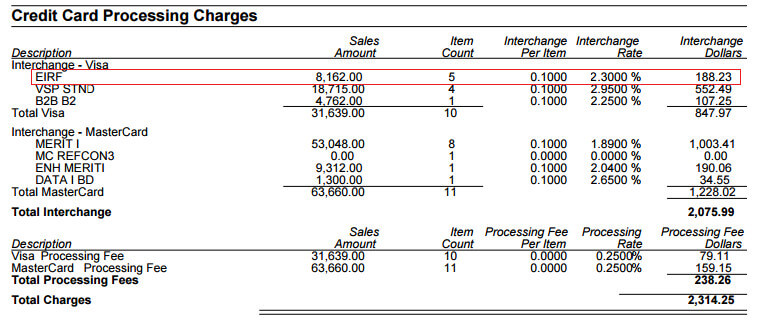

I’ve been reviewing processing statements for years now and I still see things that make me scratch my head. Part of it is because this is an incredibly complex industry to begin with, and part of it is because many companies exploit that complexity to hide more fees in order to make more money. Recently, I was reviewing the statements of one my clients and saw that they had a number of EIRF charges. After talking to them and letting them know why they’re occurring and how to prevent it, I figured I’d write about it to share my experience with others.

EIRF stands for Electronic Interchange Reimbursement Fee. It’s a pricing downgrade for certain Visa transactions. Typically, these occur because the batch wasn’t settled in a timely fashion (2 days for EIRF, 3 days for standard), the settlement amount is different than the authorized amount (only for merchant types that don’t allow for variances like places that accept tips or gas stations), or you have missing information when the transaction is submitted (usually the cvv code or address verification information).

Let’s address these one at a time. First, you should be batching out every day that you have transactions. Never, ever let batches go unsettled. Whether you have a virtual terminal, mobile application, or a traditional terminal you should be able to set it to batch out automatically. Restaurant and salon owners (or any business that accepts tips) may not want to auto batch their transactions because if you batch out a tipped transaction without adjusting the total amount to include the tip, it’s a royal pain in the arse to go back and do it afterwards. You’ll need to send in signed receipts to the processor and wait several days to get that money back. That’s the one exception I can think of, but all other merchants need to automatically batch out daily.

Secondly, you shouldn’t settle a transaction for a different amount than what it was authorized for. Let’s say you own a limo company and you’ve booked a party for four hours. You’ve taken the payment information over the phone and processed it through your virtual terminal. Then, a few minutes later you get a call back and the customer tells you they want to book you for 6 hours instead of 4 and want to pay the difference. Because the transaction is still sitting in your current batches, you’re tempted to go in and adjust the price after the fact because that seems like a logical solution. Don’t do it. Void that transaction and authorize a new one for the updated amount. If you adjust the settlement amount after the authorization, you will get hit with an EIRF downgrade. Typically, cases like this have a much higher rate of chargeback due to miscommunication between the merchant and the customer, so the processors charge more to offset the risk involved. Voiding the transaction and starting over is the safer and cheaper way to go.

Lastly, the more information you can provide on a keyed in transaction, the better off you are. Most virtual terminals and mobile applications will require the cvv code (the 3 digit code on the back of a Visa/MasterCard/Discover, and the 4 digit code on the front of an AMEX) to process a transaction. However, many retail terminals don’t require that. So when you call to place a Chinese food order and you give them your card over the phone and they don’t ask for the cvv code, they’re paying more because of it. Where virtual terminals and mobile applications fall short is on the address information. By default, many of them will allow you to process a transaction without address verification information (typically all they need is the numerical house number, but you should enter the entire address to be safe). This was the case with my clients. They were using Converge, both the virtual terminal and the mobile application, and to save time they were just skipping the address information to process the payment and move on. Once I brought it to their attention, they started inputting the information properly.

In this particular example, they were paying the rate of 2.30% for their EIRF downgrades. The actually interchange rate for those cards could’ve been as low as 1.54%, which means they were paying an extra 76 basis points just because they didn’t take the extra few seconds to enter the address. In this example, 76 basis points on $8162 equates to $62.03 extra, worst case scenario. So it can get pretty expensive, pretty quickly. It’s also worth noting that this downgrade happens at the interchange level. Many merchant services providers will inflate the downgrade even more or have you on a tiered pricing system that automatically puts you on the non-qualified tier to exploit the mistake.

That brings me to my last point: always always always take the time to review your monthly statements and ask questions if something doesn’t look right. You’d be surprised how much money MSP’s get away with taking from their clients simply because people aren’t paying attention. Don’t let that happen to you.